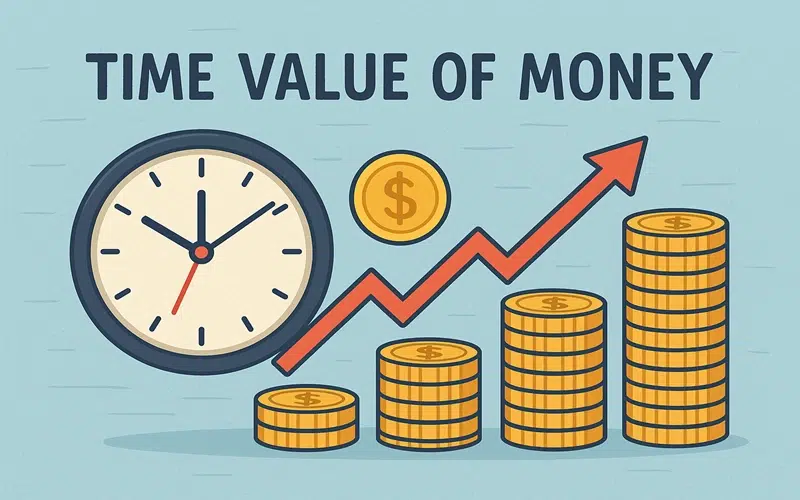

Have you ever wondered why your parents or teachers say things like, “It’s better to save now,” or “Invest your money wisely”? There’s a reason behind it, and it’s called the Time Value of Money.

What Is the Time Value of Money?

The Time Value of Money means that money you have today can grow over time if you use it wisely. This happens because money has the ability to earn. If you put it in a bank or invest it, it can give you more money later. So, ₹100 today is not the same as ₹100 one year from now.

Example:

If you have ₹100 today and put it in a bank that gives 5% interest per year, you’ll have ₹105 next year. But if someone offers you ₹100 next year, it’s actually less valuable because you missed the chance to earn that ₹5.

Read More: famousparenting momlife

Why Is the Time Value of Money Important?

Understanding the Time Value of Money helps you make better decisions about:

-

Saving your money

-

Investing in the future

-

Borrowing or lending money

-

Choosing between spending now or later

This concept shows up everywhere—in school savings, business decisions, government budgets, and even when you decide to buy a phone now or wait for a sale later.

Key Elements That Affect the Time Value of Money

Let’s look at the things that make your money grow (or shrink) over time:

1. Interest Rate

This is the amount of money you earn on savings or pay on loans. Higher interest means more growth.

2. Time (Duration)

The longer you save or invest, the more your money grows. Time and interest work together to increase your wealth.

3. Present Value

This tells you how much future money is worth today.

4. Future Value

This tells you how much today’s money will be worth in the future.

Simple Formula to Understand Time Value of Money

You don’t need to be a math wizard to use this simple formula:

Future Value (FV) = Present Value (PV) × (1 + interest rate)ⁿ

Where:

-

PV = Money you have now

-

Interest Rate = How much your money grows each year

-

n = Number of years

Example:

If you save ₹1,000 at 6% interest for 2 years:

FV = 1000 × (1 + 0.06)² = 1000 × 1.1236 = ₹1,123.60

So, your ₹1,000 will become ₹1,123.60 in two years!

Real-Life Uses of the Time Value of Money

You might think this is only for adults or bankers. Not true! You use the idea without even knowing it. Here’s how:

1. Savings Accounts

Banks give you interest when you keep money with them. This is your money growing with time.

2. Loans and EMIs

When you borrow money, the lender charges interest. Why? Because they lose the chance to earn from that money while you use it.

3. Investments

When you invest in shares, gold, or property, you’re hoping the value will grow over time.

4. Planning for Goals

Want a bicycle next year? If you start saving now, you may need to save less than waiting until the last moment.

Time Value of Money in Daily Life (Kid-Friendly Examples)

Let’s make this even simpler:

🍫 Example with Chocolate:

You have ₹50 today. You can buy 5 chocolates now. But if prices go up next year and each chocolate costs ₹12, you’ll get only 4 with the same ₹50. So, your money’s buying power went down. That’s why it’s better to use or invest your money smartly now.

🎮 Example with Video Games:

Suppose you want a game that costs ₹2,000. If you start saving ₹200 every month, you’ll have enough in 10 months. But if you wait 6 months to start saving, you’ll have to save ₹333 every month. See how time affects money?

Tips to Use the Time Value of Money in Your Life

-

Start saving early—even small amounts help

-

Understand interest rates when borrowing or saving

-

Don’t delay your goals—use time to your advantage

-

Learn to compare present vs. future costs

Common Mistakes People Make

Even adults sometimes ignore the Time Value of Money. Here are a few mistakes you should avoid:

-

Spending all your money without saving

-

Taking loans without checking the interest rate

-

Waiting too long to invest or save

-

Thinking ₹1,000 today is equal to ₹1,000 in 5 years

By understanding this idea, you can avoid these traps and make better choices with your money.

The Power of Compound Interest

One of the most amazing things linked to the Time Value of Money is compound interest. It means earning “interest on interest.”

Let’s say:

-

Year 1: You earn ₹100 interest on ₹1,000 (10% interest)

-

Year 2: You earn ₹110 interest—not just on the original ₹1,000, but also on the ₹100 interest from Year 1!

Over time, this small difference becomes a big deal. That’s how many people grow wealth by starting early.

How Businesses Use the Time Value of Money

Companies use this idea to:

-

Decide whether to buy new machines now or later

-

Compare different projects or investments

-

Make smart choices about money loans and repayments

Even big companies rely on this simple idea to make millions!

Final Thoughts

The Time Value of Money is not just for bankers, adults, or rich people—it’s for everyone, including you. When you understand how time affects money, you start making smarter choices. Whether you’re saving for a toy, a game, or your future education, knowing that money today is more valuable than money tomorrow will always help you.

So the next time you think about spending all your allowance, remember this: a little saved today could become something big tomorrow. That’s the power of time and money together.

Top 3 Frequently Asked Questions (FAQs)

1. What is the time value of money in simple words?

It means money today is worth more than the same amount in the future because it can grow or earn interest over time.

2. How can I use the time value of money in real life?

You can save early, invest, or avoid unnecessary loans. Even small savings today can grow a lot in the future thanks to this concept.

3. Why does money lose value over time?

Prices go up over time due to inflation, and if your money doesn’t earn interest, it can buy less in the future than it does today.

Read More: look what mom found